nassau county tax grievance application

Put Long Islands 1 Rated Tax Reduction Company to Work for You. Ways to Apply for Tax Grievance in Nassau County.

Nassau County Tax Grievance Property Tax Reduction Long Island

I represent that the.

. Simply apply below to have us correct your 2022 assessment. Submitting an online application is the easiest and fastest way. Nassau County Tax Reduction Application.

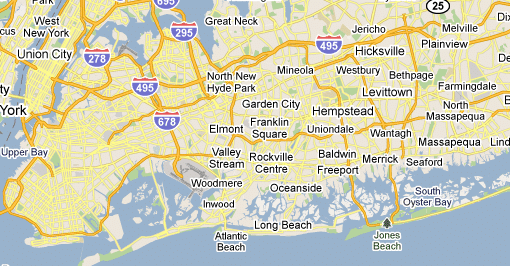

The first step in the process is to file an affidavit with your county assessors office within six months after the assessment date on which the taxes are based or before June 30th if you have not yet received that notice. However the property you entered is not located in Nassau County and we only file tax grievances for Nassau County properties. The deadline is before March 1 2019 so you need to file your grievance by then or you will need to wait until March 1 2020 before you can file a grievance covering the 2021 to 2022 tax year.

New York City Tax Commission. Suffolk County Tax Grievance Form. Reserves the right to withdraw this application if a duplicate filing is.

Long Island Tax Grievance. Appeal your property taxes. Click this link if you prefer to print out the application in PDF form and fax it to.

Click this link if you prefer to print out the application in PDF form and fax it to. Ways to Apply for Tax Grievance in Nassau County. Phone 516 342-4849 Email.

Click to request a tax grievance authorization form now. For Other types Property pdf file Instruction for form AR2. Nassau County Tax Grievance Application 2016-03-01T154626-0500 The Nassau County filing deadline has passed to grieve your 2017-2018 property taxes.

NO REDUCTION NO FEE Calculating our fee is easy. Sign up before the May deadline for us to assist in completing your application. Nassau County Tax Grievance Application 2016-03-01T154626-0500 The Nassau County filing deadline has passed to grieve your 2017-2018 property taxes.

Click Here to Apply for Nassau Tax Grievance. Nassau County Retainer -NO REDUCTION NO FEE- 1. Nassau County Property Tax Grievance Information - deadlines info links to help commercial property owners in Nassau NY grieve their property taxes Realty Tax Challenge - 10 Hub Drive Ste 5 Melville New York 11747 SPEAK WITH A TAX ASSESSMENT SPECIALIST.

24662yr - Mill River Rd Upper Brookville. Which application form should I use. Apply below or simply fax email or mail it to us.

Joseph Barrera Lighthouse Tax Grievance Corp Rep. Our Record Reductions in Suffolk County. Please check back in a few days to sign up for next year.

LOWER YOUR PROPERTY TAXES WITH MAIDENBAUM. Our Record Reductions in Nassau County. Use Form RP-524 Complaint on Real Property Assessment to grieve your assessment.

If you mail the form it must be received by the assessor or BAR no later than Grievance Day. 29185yr - Old Field Rd Old Field. Submitting an online application is the easiest and fastest way.

You then have until April 15th to. For a 1 2 or 3 Family House pdf file Instruction for form AR1. The undersigned being an aggrieved party within the meaning of the Real Property Tax Law hereby authorizes the below representative to act as our agent to file with the Nassau County Assessment Review Commission.

ARC s online Sales Locator is available to help you evaluate the accuracy of the new assessment for your. You can follow our step-by-step instruction to file your tax grievance with the Nassau County Department of Assessment to have your property taxes lowered for FREE or have one of our staff file you grievance for you. Submitting an online application is the easiest and fastest way.

This website will show you how to file a property tax grievance for you home for FREE. If you are looking for a service to help you grieve your homes property tax assessment and are located within Nassau County New York. 18334yr - Old.

Nassau County Residential Property Tax Grievance Authorization Eligibility. Properties outside New York City and Nassau County. The form can be completed by yourself or your representative or attorney.

Simply get in touch with Gold Benes the premier flat rate tax grievance law firm in Nassau County. New York City residents. Click Here to Apply for Nassau Tax Grievance.

In most communities the deadline for submitting Form RP-524 is Grievance Day see below. In order for us to file on your behalf to correct your property tax assessment and reduce your taxes all you have to do is fill out our application. Looking to reduce your Long Island property taxes.

Between January 3 2022 and March 1 2022 you may appeal online. Get Free Commercial Analysis. 75443yr - Brookville Rd Brookville.

Nassau County Assessment Review Commission. Petition to correct the tentative andor final assessment for the 20222023 Nassau County SchoolGeneral tax roll and separate 20212022 VillageCity if necessary. Click this link if you prefer to print out the application in PDF form and fax it to.

Suffolk County Tax Reduction Application. File the grievance form with the assessor or the board of assessment review BAR in your city or town. Visit our social pages.

Ways to Apply for Tax Grievance in Nassau County. Nassau County Tax Grievance Form. Click to request a tax grievance authorization form now.

We offer this site as a free self help. 34817yr - Foxhunt Crescent Syosset. The grievance process has been extended until May 2 2022 for the 20232024 tax year.

Suffolk County Tax Grievance Form. For Tax Class and Exemption Claims pdf file Instruction for form AR3. The Nassau County Department of Assessment offers a property tax appeal process.

Ad Download Or Email Form RP-524 More Fillable Forms Try for Free Now. Deadline for filing Form RP-524. You may file an online appeal for any type of property including commercial property and any type of claim including errors in your propertys tax class or exemptions.

Click Here to Apply for Nassau Tax Grievance. A successful grievance allows for a potential reduction of your general and school property taxes. Property Tax Reduction Forms.

At the Cobra Consulting Group we provide consulting for select services on a concierge basis so you can meet your business requirements efficiently without having to retain multiple service providers. We are here to help. Nassau County Tax Grievance Form.

Make Sure That Nassau County S Data On Your Property Agrees With Reality

Nc Property Tax Grievance E File Tutorial Youtube

Property Tax Reduction Consultants Home Facebook

Property Tax Assessment Grievance Workshop Herald Community Newspapers Liherald Com

How To File For A Nassau County Property Tax Grievance Your Online Property Tax Grievance Center For Nassau County Long Island

Tax Grievance Deadline 2022 Nassau Ny Heller Consultants

How To File For A Nassau County Property Tax Grievance Your Online Property Tax Grievance Center For Nassau County Long Island

How To File For A Nassau County Property Tax Grievance Your Online Property Tax Grievance Center For Nassau County Long Island

Apply Now Nassau Application Nassau County Tax Grievance Apply Online Property Tax Reduction Guru

How To File For A Nassau County Property Tax Grievance Your Online Property Tax Grievance Center For Nassau County Long Island

Not Sure How To Get A Property Tax Reduction In Nassau County Property Tax Grievance Heller Consultants Tax Grievance

How To File For A Nassau County Property Tax Grievance Your Online Property Tax Grievance Center For Nassau County Long Island

Platinum Tax Grievances Home Facebook

Nassau County Grievance Filing On Property Tax Property Tax Grievance Heller Consultants Tax Grievance

Nassau County Property Tax Reduction Tax Grievance Long Island

Nassau County Property Tax Reduction Tax Grievance Long Island

5 Myths Of The Nassau County Property Tax Grievance Process

Property Tax Grievance Workshop Jericho Public Library

How To File For A Nassau County Property Tax Grievance Your Online Property Tax Grievance Center For Nassau County Long Island